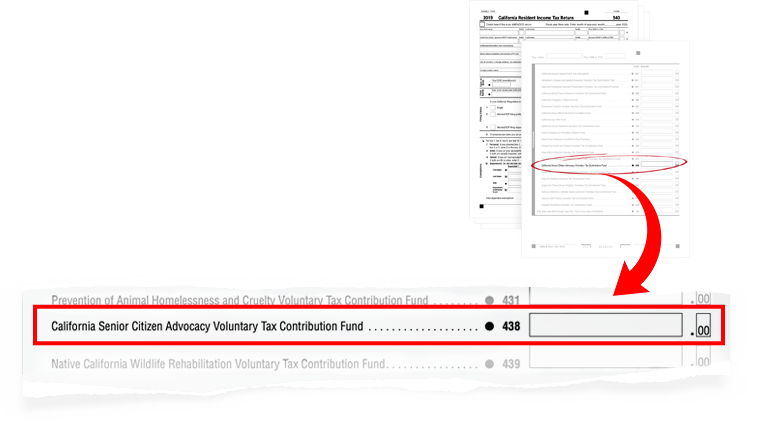

VOLUNTARY TAX CONTRIBUTION FUND

The California Senior Legislature utilizes tax

deductible donations from people like you to support its advocacy efforts.

Contribute $1 or more through the Voluntary Contribution Fund Section (Code 438, CA Senior

Citizen Advocacy Voluntary Contribution Fund)

of your California Tax Return. It is tax

deductible and provides much needed funding to

the California Senior Legislature’s advocacy efforts.

Filing your own taxes?

We’re code 438 on your Form 540 California Tax Return. Even $1 can help the California Senior Legislature. We have sponsored over 200 new laws helping seniors with financial abuse, health care, the Silver Alert program and more. If you aren’t filing right now download our reminder form below and put it with your tax documents.

Working with a tax preparer or someone else?

Send them an email now telling them you want to donate to the California Senior Citizen Advocay Voluntary Tax Contribution Fund (code 438). Or download our reminder form below to put with your tax documents.

Are you using TurboTax or another tax software program?

When completing your California tax return, select “YES” when prompted to donate to a California Special Fund. Find the California Senior Citizen Advocay Voluntary Tax Contribution Fund and enter your donation amount in the box on the right of your screen.

Friends of CSL

Sign up to receive our newsletter and special events notifications via email.